B2B BNPL: A Game Changer for Venture Capital in the SaaS Sector

by Leola Rice

In the dynamic world of Software as a Service (SaaS) startups, securing capital for growth has traditionally been synonymous with venture capital (VC) funding. However, a new player has entered the arena, and it's transforming the way SaaS companies approach financing.

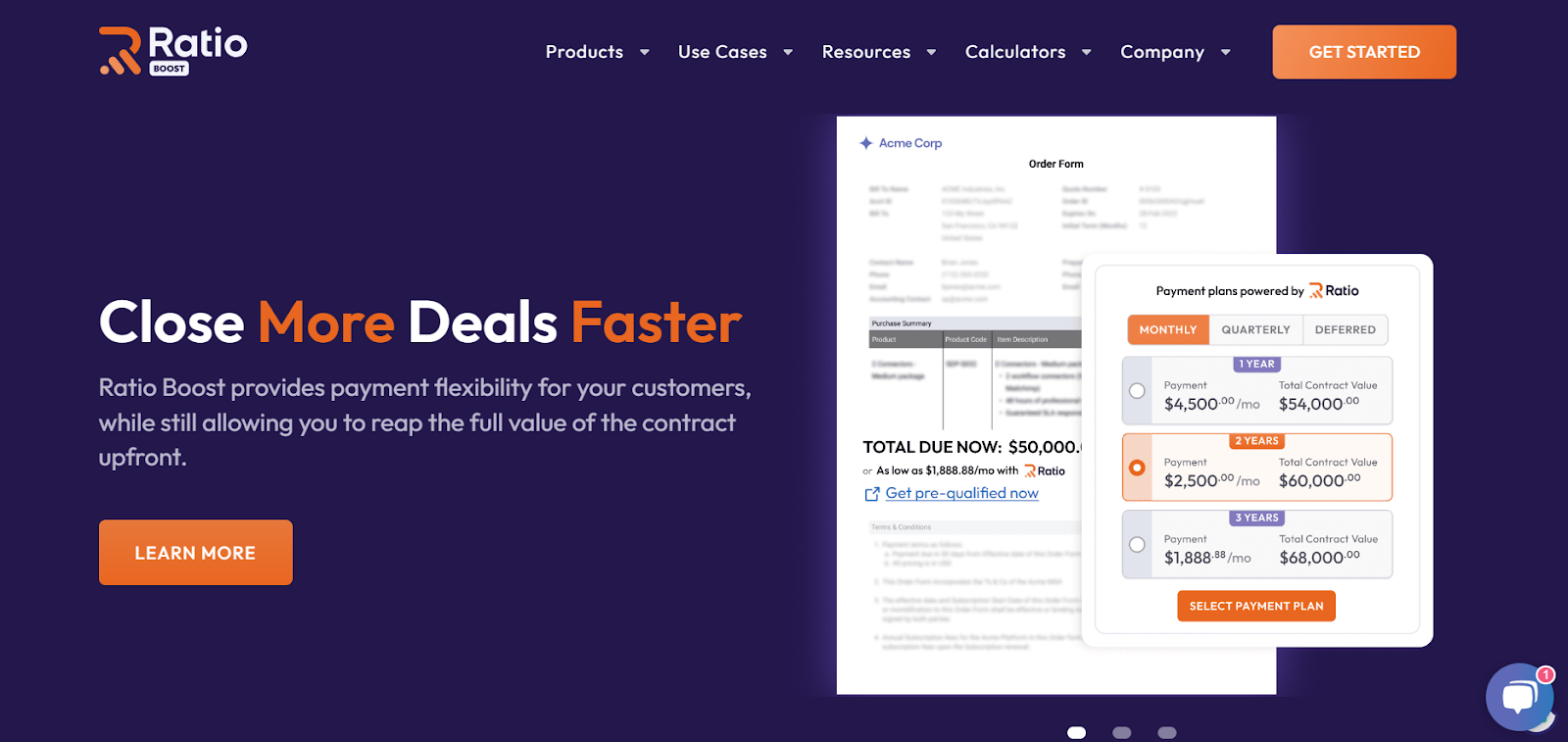

Business-to-Business Buy Now, Pay Later (B2B BNPL) financing is rewriting the rules, offering non dilutive capital and making startups reconsider whether VC funding is truly their best strategic choice. This article explores the dynamics of this transformative shift, its repercussions on VC firms, and why SaaS businesses are increasingly inclined toward more sustainable and strategic financing options.

The Rise of B2B BNPL SaaS

B2B BNPL financing is on the rise, and it's gaining attention from both SaaS companies and venture capitalists alike. Traditional VC investment trends might make it seem surprising that B2B BNPL SaaS is gaining traction, especially in times of economic uncertainty. However, this financing model is proving its worth by offering SaaS businesses a unique value proposition – non dilutive capital.

"Unlike VC investments, which often come at the cost of relinquishing ownership and control, B2B BNPL empowers SaaS startups to secure the capital they need without sacrificing equity." – Sorting Robotics, Nohtal Partansky, CEO

In an era where autonomy and strategic financial planning are paramount, this advantage is reshaping the financing landscape.

Non Dilutive Funding Startups: A Strategic Edge

Perhaps the most significant advantage that B2B BNPL brings to the table is non dilutive capital. In the traditional VC route, startups often trade ownership and decision-making power for funding. With B2B BNPL, SaaS companies maintain control over their destiny. This strategic edge is prompting entrepreneurs to question whether VC funding is still the best choice.

"SaaS startups must develop unique value propositions and show clear pathways towards profitability to stand out." – Tuff Robotics, Kyle Dou, CEO

Sustainability and Flexibility

Another compelling aspect of B2B BNPL is its sustainability and flexibility. VC funding often comes with the pressure of rapid growth and quick returns. In contrast, B2B BNPL enables SaaS companies to adopt a more measured and sustainable approach to growth, aligning with their long-term objectives.

"B2B BNPL offers equity-free funding and streamlines ecommerce processes, benefiting businesses that require consistent working capital flows." – Bitivore, Oz Eleonora, CEO

Impact on VC Firms

The rise of B2B BNPL in the SaaS sector is not without consequences for VC firms. While these firms have historically provided value beyond capital, including mentorship, networking opportunities, and industry expertise, SaaS startups are now finding alternative sources of support. The allure of non dilutive funding startups and the desire for greater autonomy are driving companies to explore financing options that may not involve VC firms.

"Every technology company should consider Ratio to optimize their capital structure and boost growth. Ratio is the best option in the market!" – AIPartnership, Mark Ellington, CFO

A Paradigm Shift in SaaS Financing

The shift towards B2B BNPL signifies a broader paradigm shift in SaaS financing. Startups are no longer solely focused on raising capital but are also prioritizing financial sustainability and strategic growth. They are reevaluating the true value that VC firms bring to the table and considering whether alternative financing options can better align with their long-term vision.

Conclusion: A New Era of SaaS Financing

As the SaaS sector continues to evolve, the emergence of B2B BNPL as a non dilutive financing solution is challenging the traditional dominance of VC funding. SaaS companies are recognizing the benefits of preserving ownership equity, adopting sustainable growth strategies, and exploring financing options that align with their unique needs and objectives. This new era of SaaS financing is reshaping the landscape, forcing VC firms to adapt and prompting startups to think strategically about their growth journeys. In this changing landscape, B2B BNPL is not just a financial tool; it's a strategic game changer for the SaaS sector, redefining how businesses access the capital needed to thrive.

In the dynamic world of Software as a Service (SaaS) startups, securing capital for growth has traditionally been synonymous with venture capital (VC) funding. However, a new player has entered the arena, and it's transforming the way SaaS companies approach financing. Business-to-Business Buy Now, Pay Later (B2B BNPL) financing is rewriting the rules, offering non…

Recent Posts

- Why Partnering with a Local Marketing Agency is Essential for Website Development Success

- SEO Services for Small Business: Boost Your Online Presence

- Lawn Care Spring Branch Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY